AssetManage 2017 supports the following five methods of calculating depreciation:

- Straight Line

- Double Declining Balance

- 125%, 150% and 175% Declining Balance

- Sum of Years Digits

- Percentage per Year

Specify Depreciation for an asset by clicking on the Depreciation tab when adding or editing an asset, as shown below.

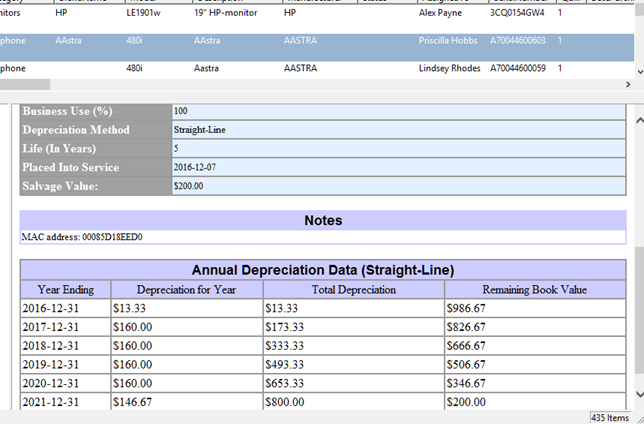

Assets with Depreciation set will show the Annual Depreciation tables in the details view, as shown below.

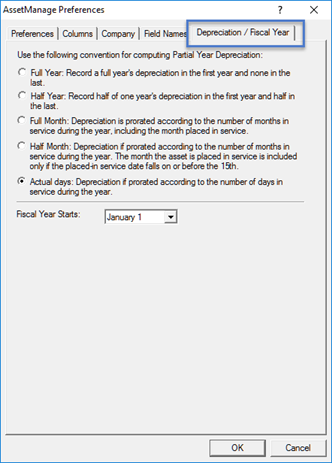

There are various methods for calculating Partial Year Depreciation. The method you wish to use can be specified in the Depreciation section of the Preferences dialog, under the Tools menu (Tools > Preferences), as shown below.

Depreciation Conventions Used in AssetManage

•Full Year: A full year's depreciation is recorded in the first year and none in the last.

•Half Year: Half of one year's depreciation is recorded in the first year and half in the last.

•Full month: Depreciation is prorated according to the number of months in service during the year, including the month placed in service.

•Half Month: Depreciation is prorated according to the number of months in service during the year. The month the asset is placed in service is included only if the placed-in-service date falls on or before the 15th.

•Actual days: Depreciation is prorated according to the number of days in service during the year.